What is Difference Between Crypto and Bitcoin?

Difference Between Crypto and Bitcoin

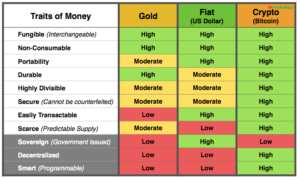

Cryptocurrencies like Bitcoin are distributed digital currency networks. The blockchain is an open, distributed ledger that provides the legitimacy of the coins. Each block contains a timestamp and hash of previous blocks, as well as transaction data. Blockchains are resistant to changes because they are decentralized and are typically managed by a peer-to-peer network. As a result, they are not as vulnerable to hackers as traditional currencies.

While Bitcoin is a popular investment option for novices, some savvy investors have opted for other assets in anticipation of the rise of Bitcoin. The cryptocurrency industry has attracted international institutions and world leaders, and has experienced a dramatic rise in encryption services and platforms. Moreover, Bitcoin has performed better than any other asset class in recent history. Unlike a traditional currency, cryptos are meant to be easier to use and transfer than cash.

The governing bodies of various countries have categorized cryptocurrencies differently. For instance, the China Central Bank prohibited the handling of Bitcoins in early 2014. Since these networks are unregulated, they have been accused of enabling criminal activity. However, traditional financial products have strong consumer protections against fraud and money laundering. The accounts of those wishing to make a wire transfer must be verified before the funds are transferred. Unlike with cryptocurrencies, traditional banks require the account holder to present proof of identity prior to receiving a wire transfer.

What is Difference Between Crypto and Bitcoin?

During the early days, digital coins were primarily used for anonymous trading. In the years that followed, however, Bitcoin became a popular choice for criminals and hackers. Although this usage of cryptocurrency should not be encouraged, it should not put every crypto user in the spotlight. Users of centralized exchanges are required to identify themselves when accessing an exchange. This is why there are stricter KYC requirements for centralized exchanges.

Cryptocurrency transactions are also secured by encryption. The system facilitates transactions through centralized institutions. A centralized exchange has the advantage of being more secure than an open network, but it is also prone to attack from hackers. This makes the centralized exchanges vulnerable to attacks. In addition to being a target for hackers, the centralized exchanges have slowed down the development of cryptocurrencies as a whole.

Cryptocurrencies are not transparent, unlike fiat currency. Instead, they are backed by governments and are exchangeable. The difference between cryptocurrency and fiat currency lies in the way they are regulated. In a fiat currency, the government issues the currency. The central bank controls the monetary value of the currency. Cryptocurrencies can be regulated or decentralized, while centralized currencies are not.